This is our 5th Session under the “Knowledge Spectrum Series” – Agriculture Infrastructure Fund and Other Schemes for FPOs

Speaker: Mr Bhujanga Rao, Team Leader, Project Monitoring Unit [Agri Infra Fund (AIF)], NABARD, NABCONS

YouTube link for the session

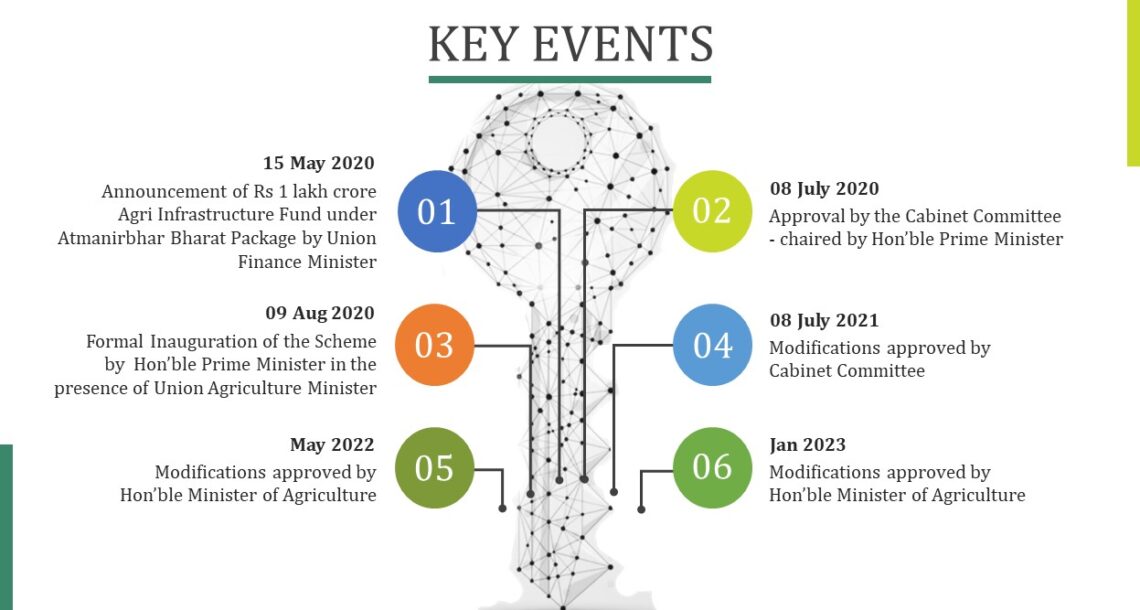

The Background of the Scheme

The Agriculture Infrastructure Fund (AIF) Scheme was launched on 15th May 2020, as a part of the Atmanirbhar Bharat Abhiyan (Self-Reliant India Initiative) by the Government of India. The scheme aimed to provide financial support and assistance to eligible entities involved in the creation of post-harvest agriculture infrastructure and community farming assets.

The other important milestones so far are given below

Under the scheme, a fund of INR 1 lakh crore (1 trillion rupees) was allocated by The Government for four years starting from the financial year 2020-21. The fund was provided through loans to eligible beneficiaries at concessional interest rates.

The National Bank for Agriculture and Rural Development (NABARD) was designated as the principal agency for the implementation and monitoring of the Agriculture Infrastructure Fund Scheme. Interested individuals, farmers, Farmer Producer Organizations (FPOs), agri-entrepreneurs, start-ups, and other eligible entities could approach NABARD or the participating banks for availing loans under the scheme.

Importance of the AIF Scheme

The AIF is important for a number of reasons. First, it will help to reduce post-harvest losses in agriculture. Currently, India loses about 40% of its food produce due to poor post-harvest handling and storage. The AIF will help to build cold storage facilities, warehouses, and other infrastructure that will help to reduce these losses.

Second, the AIF will help to bridge the infrastructure gap in agriculture. Currently, there is a lack of adequate infrastructure for irrigation, marketing, and processing of agricultural produce. The AIF will help to fill this gap and make agriculture more efficient and profitable.

Third, the AIF will help to reduce the dependency of farmers on intermediaries. Currently, farmers have to sell their produce to intermediaries at a low price. The AIF will help farmers to set up their own storage and marketing facilities, which will give them more bargaining power.

Fourth, the AIF will help to accelerate the adoption of technology in agriculture. Currently, the adoption of technology in agriculture is slow. The AIF will help to provide financial assistance to farmers for the adoption of new technologies, such as drip irrigation, precision farming, and cold storage.

Fifth, the AIF will help to provide long-term institutional funding for agriculture. Currently, there is a lack of long-term institutional funding for agriculture. The AIF will help to provide this funding, which will help to boost investment in agriculture.

Overall, the AIF is a very important scheme that will have a significant impact on the Indian agriculture sector. It will help to reduce post-harvest losses, bridge the infrastructure gap, reduce the dependency of farmers on intermediaries, accelerate the adoption of technology, and provide long-term institutional funding for agriculture.

Here are some additional details about the AIF:

- The scheme is beneficial to all stakeholders in the agriculture sector, including individual farmers, Farmer Producer Organizations (FPOs), Joint Liability Groups (JLGs), Self Help Groups (SHGs), Large Businesses like FMCG players, Exporters, Food Processors, Agri Entrepreneurs like individual business owners, Startups, Supply Chain players, and state agencies like Agricultural Produce Marketing Committees (APMCs), Federations of FPOs, SHGs, Cooperatives and State Warehousing Corporations

- The AIF will provide financial assistance for a wide range of agriculture infrastructure projects, including cold storage facilities, warehouses, irrigation systems, marketing infrastructure, processing facilities, supply chain infrastructure, other livelihood activities like Hydroponic farming, Mushroom farming, Polyhouse/Greenhouse, Aeroponic farming, Bio-Stimulant Production, etc. Input Production, technological services like the purchase of drones, sensors on the field, blockchain technology and AI also, etc.

Allocation of the fund to the Telangana State is ₹ 3075+ Crore out of the total fund of ₹ 1 Lakh Crore, available on FCFS.

Key Features of the AIF Scheme

- Interest Subvention: The AIF Scheme provides an interest subvention of 3% per annum on loans up to ₹2 Crores. This means that the effective interest rate for eligible projects will be 6% per annum. The interest subvention is available for a maximum period of 7 years.

- Credit Guarantee: The AIF Scheme also provides credit guarantee coverage for loans up to ₹2 Crores. This means that the lending institution will be protected against default by the borrower. The credit guarantee is provided by the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

- Convergence: The AIF Scheme allows for convergence with other schemes of the government of India and state governments. This means that projects that are eligible for funding under other schemes can also be funded under the AIF Scheme.

- Project Eligibility: The AIF Scheme is open to a wide range of agriculture infrastructure projects, including:

- Cold storage facilities

- Warehouses

- Irrigation systems

- Marketing Infrastructure

- Processing facilities

- Agri-clinics and hospitals

- Farmer producer organizations (FPOs)

- Farmer-friendly retail outlets

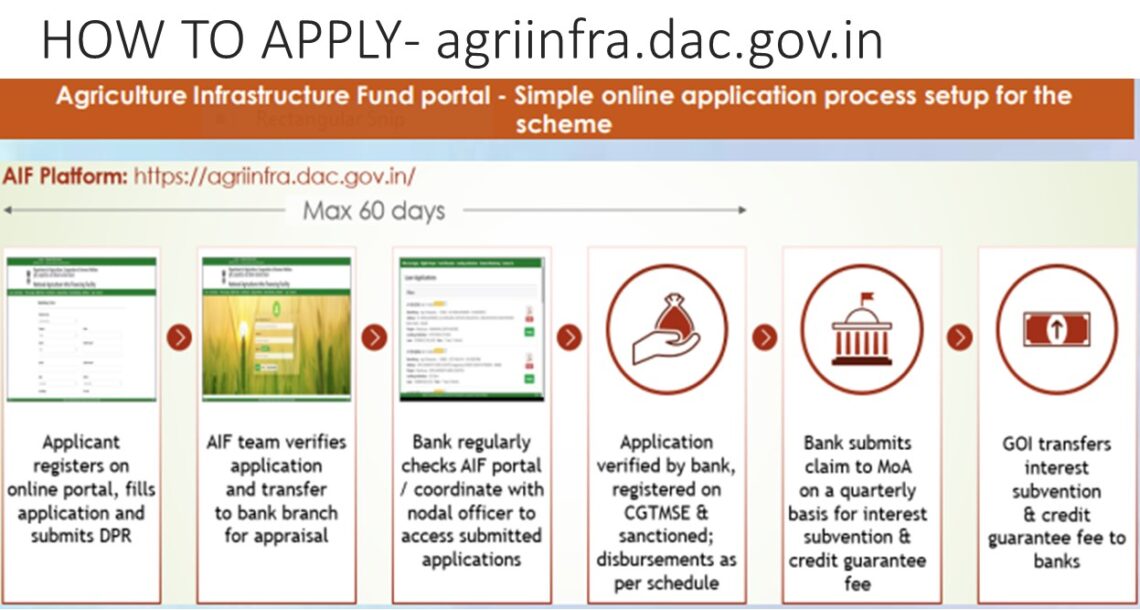

The application process for the agricultural infrastructure fund scheme

The process flow is designed to be efficient and transparent. The applicant can track the progress of their loan application through the AIF portal. The AIF team will also keep the applicant updated on the progress of the project. The process is

- Registration and Submission of Loan Application on Portal: The applicant must first register on the AIF portal and submit a loan application. The application must include the following information:

- The name and address of the applicant

- The details of the project

- The amount of loan requested

- The financial projections for the project

- Verification: The loan application will be verified by the AIF team. This includes checking the eligibility of the applicant, the viability of the project, and the financial projections.

- Sanction and Disbursement: If the loan application is approved, the loan will be sanctioned and disbursed. The disbursement will be made directly to the project account.

- Monitoring and Evaluation: The AIF team will monitor the progress of the project and evaluate its performance. This will help to ensure that the project is successful and that the funds are used for their intended purpose.

The AIF Scheme facilitates the convergence with some of the other major schemes like Sub Schemes under the Mission for Integrated Development of Horticulture (35% – 50% capital subsidy for infra including cooling units, pack house, ripening chambers, reefer vans, etc.); PM Formalization of Micro Food Processing Enterprises Scheme (PMFME – 35% capital subsidy along with additional support for FPOs, SHGs and Cooperatives for working capital, training, DPR preparation); Sub Mission on Agriculture Mechanization (SMAM – Upto 40% subsidy for the establishment of custom hiring service centres)l Gobar-Dhan-Ministry of Jal Shakti (Financial Assistance of Rs. 1.0 Cr. per 12000 cum/day for Bio Gas plants and Rs. 4.0 Cr. oer 4800 Kg/day for Bio-CNG plants). Similarly, there are other schemes like PM-KUSUM, Operation Greens: From Top to Total; Rashtriya Krishi Vikas Yojana (RKVY), PACs as MSC and Integrated Scheme on Agriculture Cooperation (ISAC) by NCDC.

Benefits of Convergence

Agri Infra Fund is a Top-up scheme which can be converged with all other central and state government schemes. MoA&FW is creating modules with each of the schemes for easy availability of multiple scheme benefits by the applicants. Convergence of multiple schemes will facilitate the ‘whole of government approach’ of putting the benefits on a single platform across ministries with ease. The benefits of convergence are:

- Convergence means combining various schemes to provide additional benefits to the beneficiaries which would not be possible if benefits were availed individually.

- Convergence especially becomes important for AIF since it is a Top-up scheme and additional benefits can be passed on making the venture viable and sustainable.

For the AIF Support Schemes under various activities, please go through the video link.

Key Learnings from the Session

- Developing course modules to be used by the FPOs

- Developing simple manuals/handbooks of the procedure of each scheme

- Convergence of various schemes is a possibility